Most provinces will require you to have at least 200000 worth of third-party liability coverage to get your vehicle on the road. The minimum requirement by law is 200000.

What Is Third Party Liability In Car Rental Rentalcars Com

The act provides the Province of British Columbia with the.

. Third Party Liability Ministry of Health PO Box 9647 STN PROV GOVT. Ad State Farm Offers Many Coverage Options. Third-party liability insurance TPL is an important form of protection found in your automobile policy.

Under Enhanced Care the need to sue for accident benefits or vehicle damage against the driver responsible is. Third party liability coverage is not without limitations. By law anyone who owns an ORV and drives on Forest Service Roads in B C is required to have third party liability coverage.

Ad General Liability Insurance Thats Affordable Tailored to You. Excess Third Party Liability Excess Third Party Liability provides coverage in excess of 200000 if you get into a crash outside of BC and injure someone or damage their vehicle. The Health Care Costs Recovery Act was passed May 29 2008 and was brought into force by Regulation effective April 1 2009.

Ad Compare Free Liability Insurance Quotes Online. The British Columbia government requires all drivers to purchase the following minimum coverage from ICBC. The exception to this rule is Quebec which.

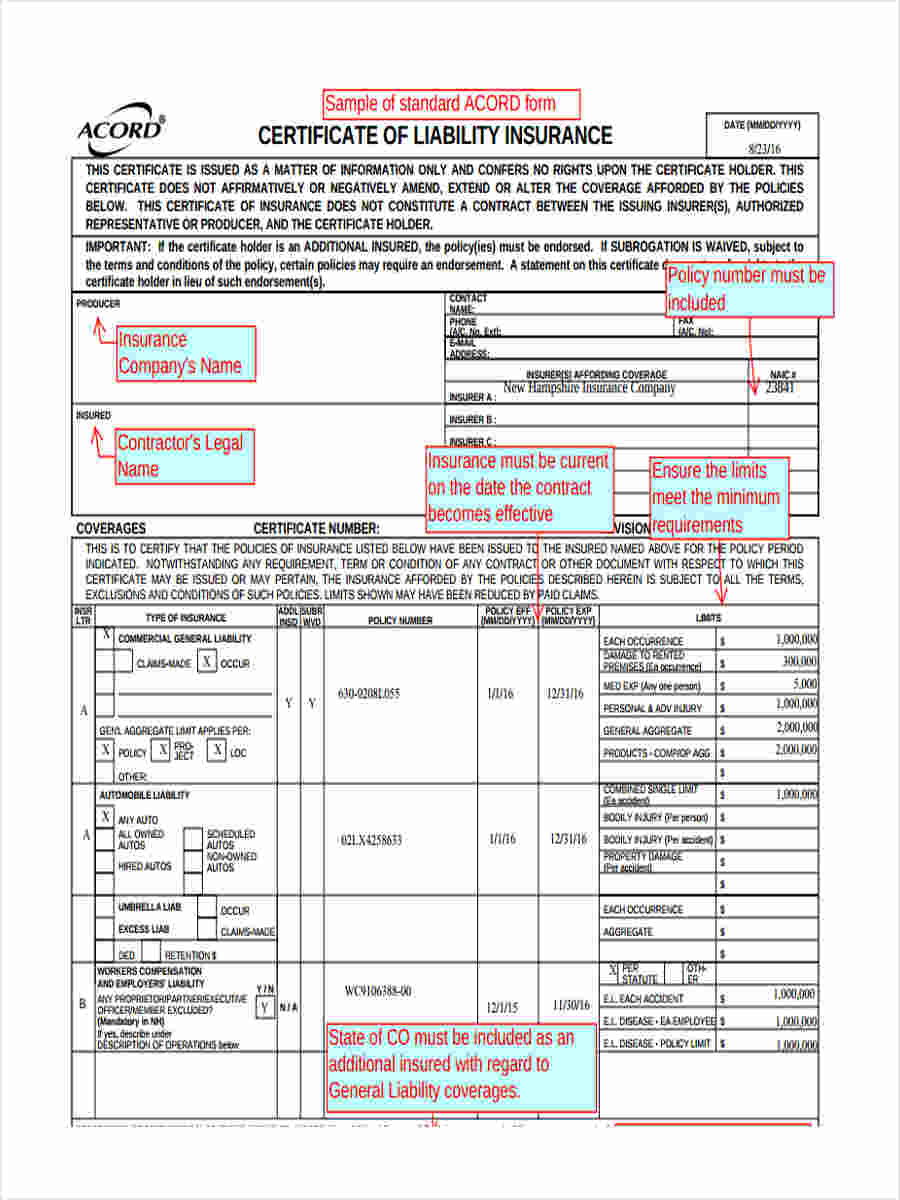

However every insurance company will recommend. Business Commercial General Liability CGL provides coverage for liability claims arising from bodily injury and property damage to others as a result of your operations. Get a Free Insurance Quote Today.

Extended Third Party Liability coverage. You can renew your ICBC car insurance by calling BCAA at 18882682222 its easy. Your Basic insurance includes 200000 in Third Party Liability TPL coverage.

To drive in British Columbia you must obtain coverage through the government insurer Insurance Corporation of British Columbia ICBC that meets the mandatory provincial. Our expert advisors will take care of all your car insurance needs including any questions you have about. Your insurance licensee resources include compliance information such as licensee responsibilities.

Optional Auto Insurance in BC is the portion of your car insurance that is over and above the Basic Insurance provided by ICBC. If you purchase ICBC basic insurance you receive an expiry decal for your plate the same as you do for your car license plate view link below to see what is included in ICBC basic. This element of a Special Event Insurance Policy provides protection for situations in which a host of an event or a concessionaire must defend themselves against.

Some British Columbia auto insurance companies will give loyalty discounts to drivers who remain active with them for years. Get Quote Buy Instantly. Third-party liability insurance in Saskatchewan covers damages to your vehicle caused by another vehicle property or injury to persons but the benefit is quite small.

In British Columbia there are mandatory coverages through ICBC. Third Party Liability Ministry of Health 2nd Floor 1515 Blanshard Street Victoria BC. Those limitations will depend on your insurer and the type and amount of insurance you purchase.

While all drivers in British Columbia must obtain their Basic Auto. Free Unlimited and Instant Certificates of Insurance Online. What You Should Know About Third-party Liability Insurance.

Insurance Quotes From State Farm Are Fast Easy. Disciplinary decisions and process. Weve taken the guess work out of auto insurance in British Columbia and have outlined the coverages available to you.

I RECOMMEND THOSE WITH SUBSTANTIAL ASSETS. At the very least I recommend that everyone get the maximum optional ICBC Third Party Liability Coverage of 5 million. If youre responsible for a crash it could cost more than you think.

200000 in third-party liability insurance It protects you in. Get Your Instant Quote Now. Out-of-province auto insurers can expect a significant reduction in the third party tort claims pursued against policyholders arising from accidents in British Columbia on or after.

Third Party Liability insurance protects you from the financial risk of an at-fault. Etc and provides coverage for Accident. Get Your Free Quote Now.

The minimum amount of third-party liability insurance in Canada is 200000 except in Quebec where its 50000.

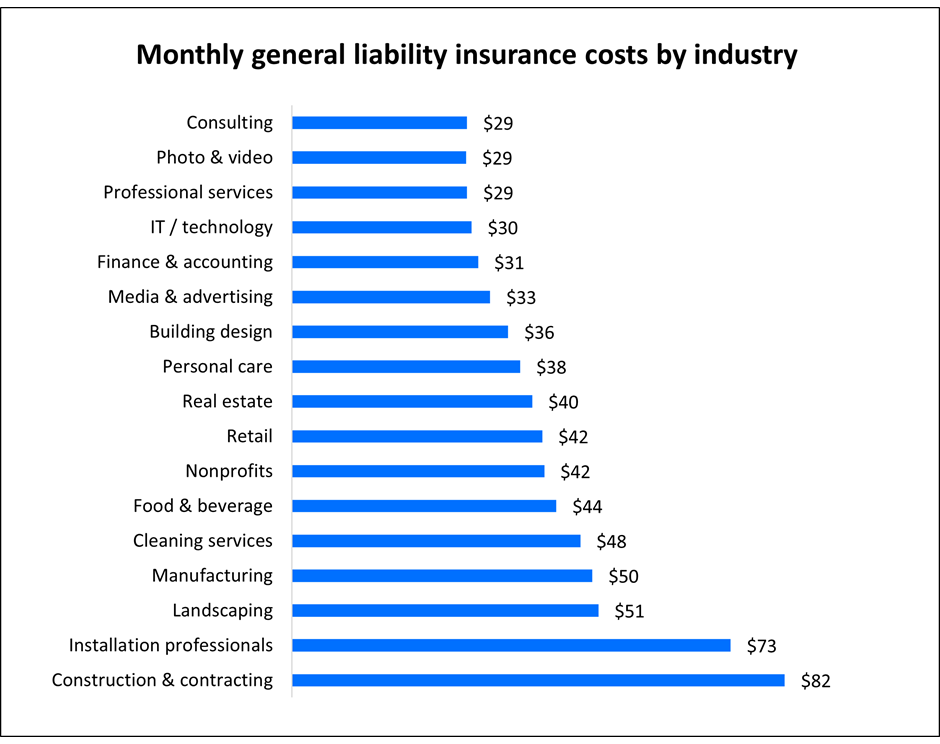

General Liability Insurance Cost Insureon

Car Insurance Online Car Insurance Comprehensive Car Insurance Best Car Insurance

Http Www Sandsinsurance Ca Auto Insurance Html Home Insurance Car Insurance Insurance

Bajaj Allianz Two Wheeler Insurance Online Know About Coverage Benefits Reviews Claim Process Premium Rates Get Your Bajaj Allai Insurance Allianz Renew

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)

Third Party Insurance Definition

Why We Recommend 2 Million Liability Coverage Mitchell Whale Ltd

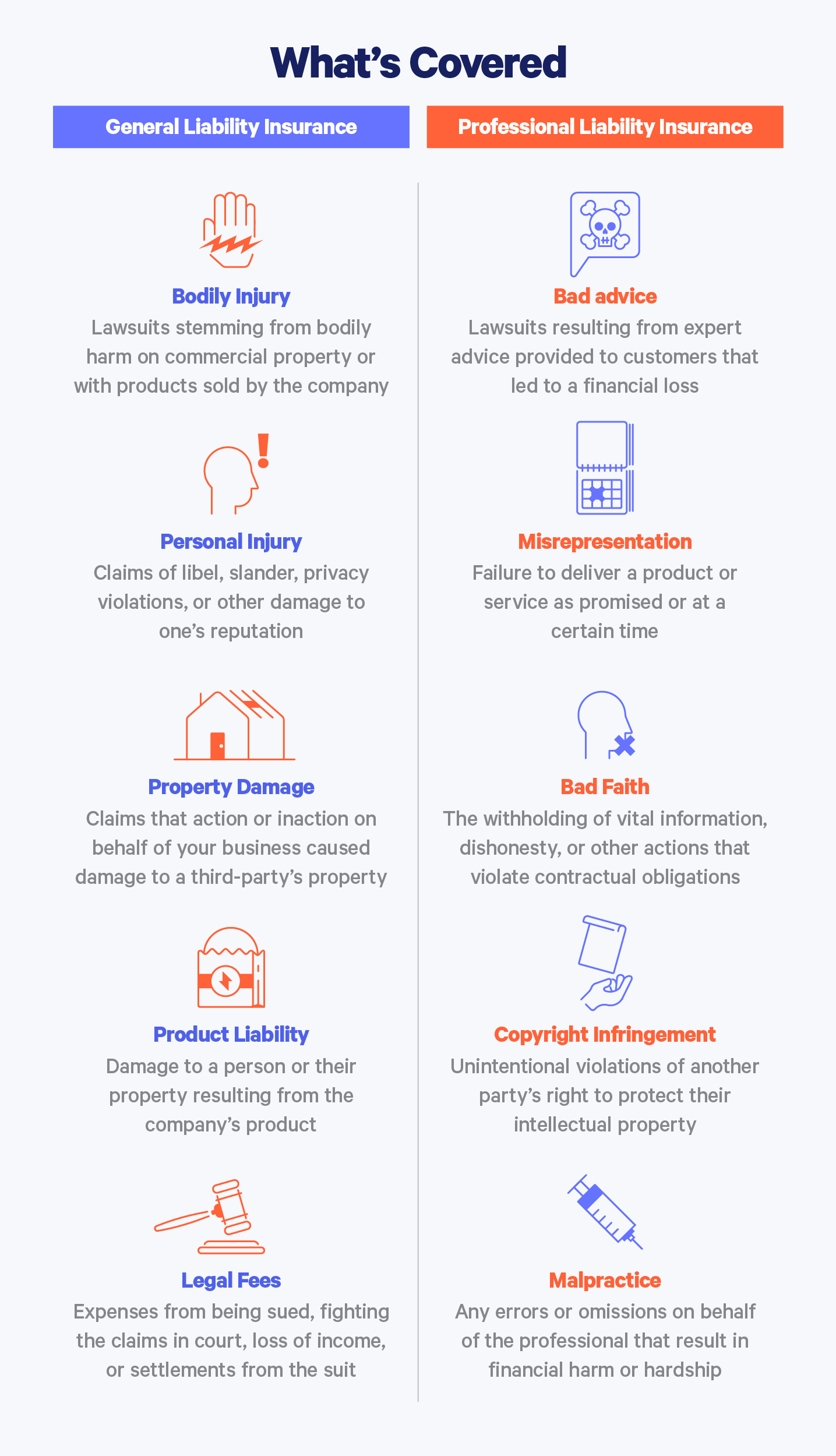

General Vs Professional Liability Insurance

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Third Party Insurance Definition

Managed Services Spinnaker Support In 2021 Health Insurance Companies Supportive Business Leader

Car Insurance Buy Renew Private Car Insurance Policy Online In India Liberty General Insurance Car Insurance Online Car Insurance Insurance

General Vs Professional Liability Insurance

Car Loans Car Insurance Car Service Pre Owned Carloan New Car Loan Car Refinance Top Up Loan Car Loans Car Buying Car Insurance

Police Accident Report Template Report Template Police Police Report

ConversionConversion EmoticonEmoticon Off Topic